Finding the best 401(k) plan…

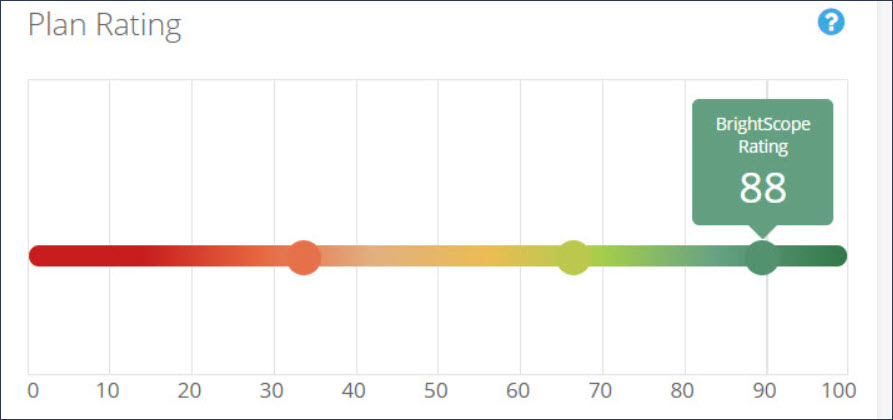

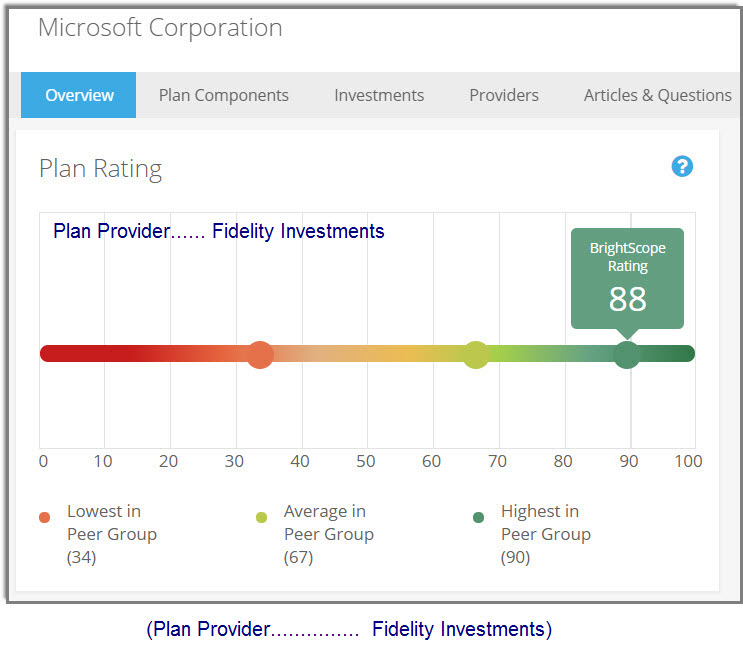

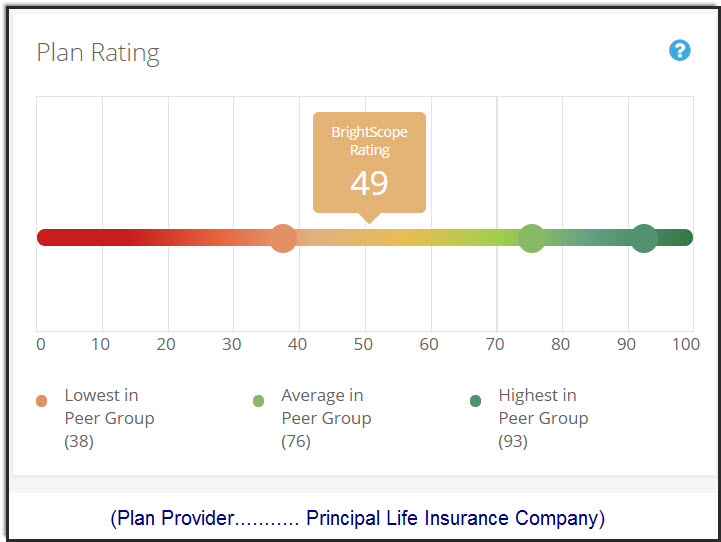

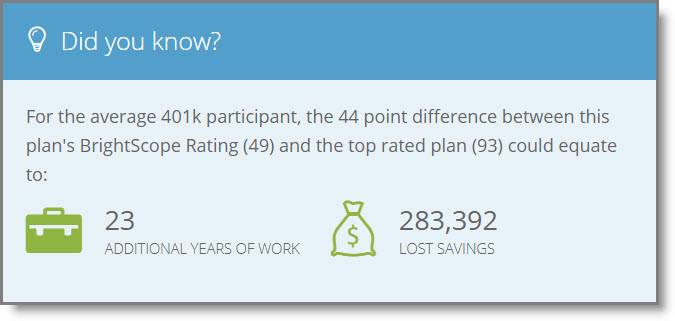

CNBC reported recently that Fidelity Investments had announced the number of 401(k) investors with more than $1,000,000 in their retirement accounts had grown to 133,000 participants in the third quarter of 2017, up from just 89,000 a year earlier. Who you have your retirement with often governs the carry forward balance you will have moving forward from one year to the next. BrightScope reports on the effectiveness of most plan providers, and Fidelity is near the top of the food chain, while Principal is obviously nearly to the bottom of the 401(k) food chain:

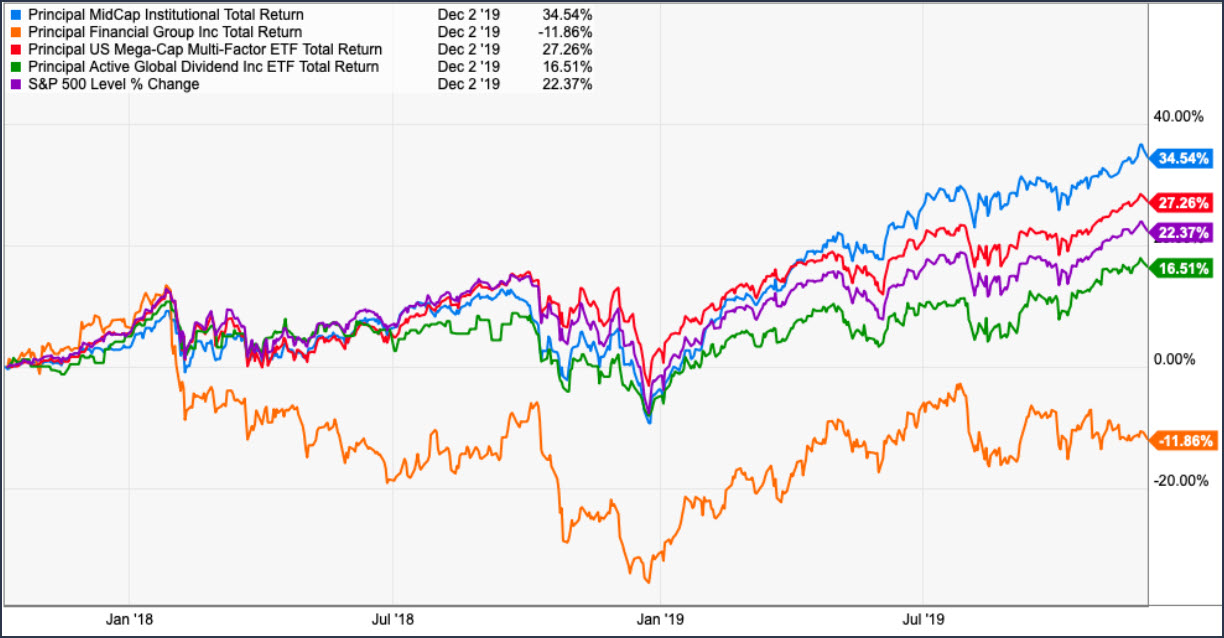

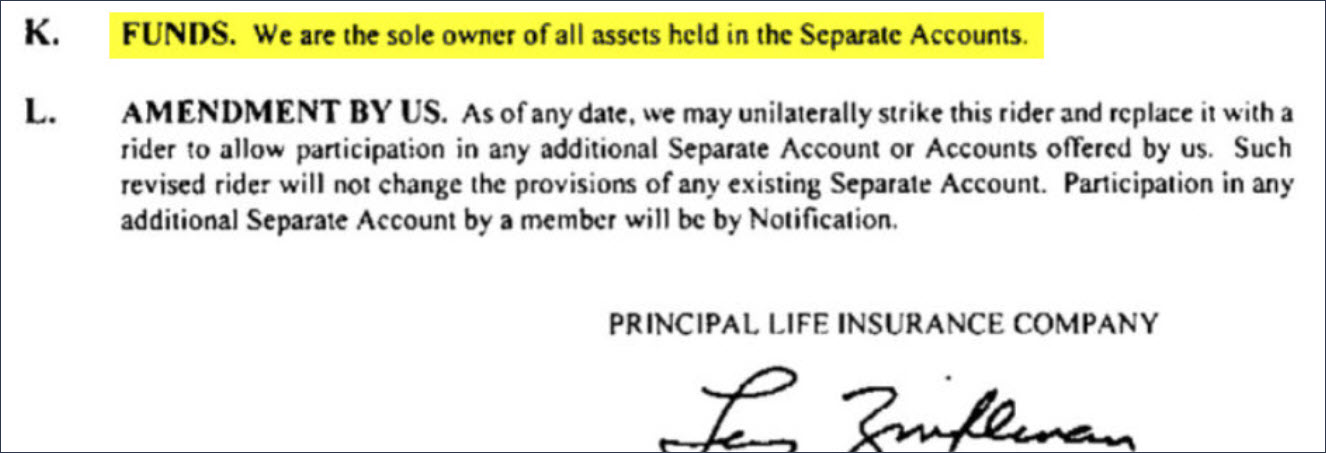

There is a reason for this fact, and it boils down to the fact that with Fidelity, YOU own your plan assets, while with Principal Life Insurance Company, Principal owns your plan assets. It is that simple. Aside from the excessive fees that Principal notoriously charges, Fidelity investors earn returns on their investments, while Principal snares the retained earnings and other increases in benefits, while they allow you their so-called “fair value” of the investment each year, as determined by Principal management. For you, the 401(k) investor, it means with Fidelity, you can pay off your house mortgage with the extra money, or send all your grandkids to college. Do the math, because it is that simple.

There is a reason for this fact, and it boils down to the fact that with Fidelity, YOU own your plan assets, while with Principal Life Insurance Company, Principal owns your plan assets. It is that simple. Aside from the excessive fees that Principal notoriously charges, Fidelity investors earn returns on their investments, while Principal snares the retained earnings and other increases in benefits, while they allow you their so-called “fair value” of the investment each year, as determined by Principal management. For you, the 401(k) investor, it means with Fidelity, you can pay off your house mortgage with the extra money, or send all your grandkids to college. Do the math, because it is that simple.

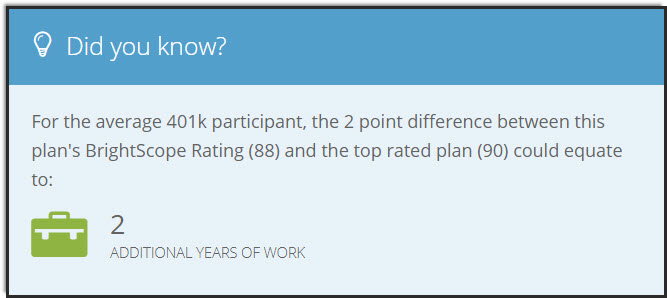

I have spent the past three years campaigning for a better 401(k) plan for insurance companies to offer, but for you, the choice is simple. If Principal’s competitors can offer a better 401(k) plan, why not buy it instead. Many of Principal’s clientele average a rating of 60 or less under the BrightScope rating system. The evidence is overwhelmingly against using Principal as a 401(k) provider, yet hundreds of thousands of 401(k) savers are still losing their investments, apparently enjoying every minute while losing their future. A convincing argument is to illustrate what would be an excellent program for investors wanting to actually save money for their retirement. To accomplish this feat, I chose Microsoft Corporation. With $15.6 billion in Net Plan Assets, they rank near or at the top of the retirement savings “food chain” for a successful 401(k). The evidence bears this fact out. BrightScope gives Microsoft Corporation a Plan rating of 88, placing it in the top 15% of all plans in its peer group.

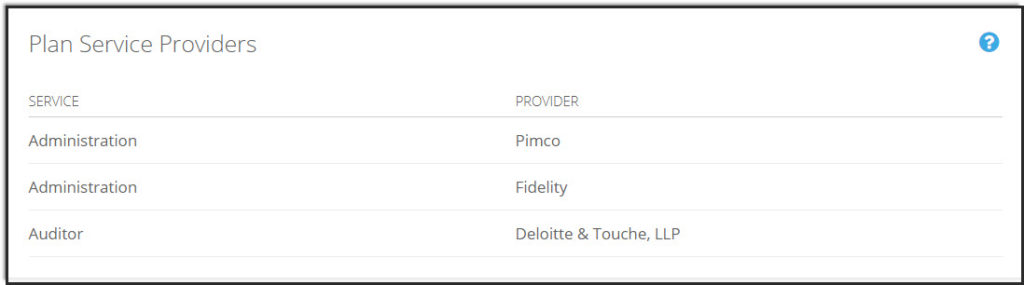

You would first argue they rank highest because they have the most money invested, and that would be partially true. The overall fees drop as the plan increases in value, but that is only part of the equation. Lets take a look at their Plan Service Providers, representing the heart of their fiduciary model:

Pimco and Fidelity are the administrators, nothing unique here. After all, Fidelity is the largest plan provider of 401(k) plans today. The auditor is Deloitte & Touche, LLP, another well known resource for auditing savings plans, and for the most part, highly reputable. Perhaps a bit more expensive than most, but can be found in most major cities.

Pacific Investment Management Company, LLC (Pimco) is an American investment management firm headquartered in Newport Beach, California, with over 2,000 employees working in 13 offices across 12 countries. They are also a large investment firm with over 1.6 trillion in Assets under Management. One thing does stand out…. Pimco has over 2000 employees, while Principal has over 10,000 employees. I guess we could say that higher numbers could result in less efficiency. “Lean and Mean” may be the right message in this case, but let’s move on.

Fidelity is the largest provider of 401(k) plans…and with over 45,000 employees, they are a major employer. But what are these firms doing right to earn the most income for investors. I suggest they are putting the investor first, and dare I say it, planning and advising in the investor’s “best interest.”

One thing really stands out when visiting the websites of these companies. Pimco goes right to work by asking the website visitor exactly what their role is… and from which of 22 countries do they originate. In other words, everything is about the investor or his representative. Fidelity immediately explains why you should invest in Fidelity… and they offer a free online checkup of your financial health. Deloitte & Touche meanwhile, use a magazine approach, flashing numerous informative articles to wet the interest of their client prospects… definitely a professional approach.

Principal opens with an impressive website and personalizes it with images of what you might consider to be average, normal, next door neighbors you like… they also like to engage their prospective clients with uncertainties, using phrases like “prepare for the unexpected,” or “retirement planning – which seems to be a very complicated, scary topic…” Principal also includes a “Retirement Wellness Score,” claiming this “score” will give you “an idea if you may be on track for retirement”. Another possible scar tactic. The home page also features a 7 minute video interview of Dan Houston, present President and CEO of Principal, introducing him and Principal as a new member of NASDAQ. This is certainly a public relations video, as can be expected.

So the website all seen to be as expected, with Principal perhaps “catering” to the less educated investor and using scare tactics to intimidate.

If you are looking for a magic bullet to explain why Principal investments rank considerable lower than competitive financial institutions, the answer will be difficult to accept, if yo are an investor with Principal today. The key element is the lack of regulation as an insurance company, which opens the door for fraud and corruption within the corporate structure. Whether on a small scale, with lower level management stealing smaller sums of money from whatever sources become available, or the top echelon of management, including Houston himself, extracting billions of dollars from their investor clientele, the end result for the investor is always the same… lower returns, or even worse in a declining economy, negative returns.

Obviously, the best 401(k) plan provider should not fleece their clients by charging excessive fees. Principal is known for excessive fees, as witnessed by the author of this book entitled “Stop the 401(k) Rip-off“, written by David B. Loeper. I have not yet reviewed the book, having just purchased it, but if the reviews are accurate, every Fiduciary administering 401(k) plans should read it. I will soon be doing a blog post on this book and others that warn investors of the pitfalls of investing with the Principal Group of Companies.

Obviously, the best 401(k) plan provider should not fleece their clients by charging excessive fees. Principal is known for excessive fees, as witnessed by the author of this book entitled “Stop the 401(k) Rip-off“, written by David B. Loeper. I have not yet reviewed the book, having just purchased it, but if the reviews are accurate, every Fiduciary administering 401(k) plans should read it. I will soon be doing a blog post on this book and others that warn investors of the pitfalls of investing with the Principal Group of Companies.

Corrupt corporations have always existed, and will continue to exist. It is a given fact, a proven fact, that financial institutions can, and will steal money. If we cannot stop the entire industry, the least we can do is to pick away at the obvious… those corporate leaders that rank highest in the food chain for crime and corruption.

There are laws that protect the 401(k) investor against criminal activities involving excessive fees, including duties to monitor the plan by the fiduciary. Tibble v. Edison International is a reminder that fiduciary responsibility includes the duty to monitor. Tibble involved a challenge by 401(k) plan participants to the retention of higher priced retail class mutual funds when allegedly materially identical lower priced institutional class mutual funds were available. The Supreme Court, stressing that all of the parties were in agreement “that the duty of prudence involves a continuing duty to monitor,” found that the appellate court had failed to consider the duty to monitor, and reversed and remanded for further consideration by the appellate court. Until a few years ago, ERISA protected “the plan,” and NOT the individual. A Supreme Court decision vacated that position, stating that individuals can file litigation on their own behalf without involving the entire plan.

If you have been wronged by any plan provider, you do have recourse. Urge your Plan Sponsor or Plan Fiduciary to seek out legal remedies, rather than remaining on the sidelines and risk a breach of fiduciary duties. It is your legal right to force companies like Principal Life Insurance Company to right a wrong, so use that right to help yourself and others.