Preface

My wife and I had saved for retirement since the early 1990’s, fully realizing we had no other means of savings or a pension to rely on when we retired. In 2008, having reached the age of retirement, we made plans to withdraw our retirement, as defined in our Group Annuity Contract with Principal, and continue working. Instead, we watched most of our life savings vaporize. Our funds sat in the Principal U.S Property Separate Account with a withdrawal restriction, being told we did not qualify to receive our totally vested savings, because they (Principal) had “redefined” the definition of retirement to include “separation of service”!

Neither of us had wanted to quit our jobs… we both enjoyed working in the catastrophe industry for almost 20 years, working claims for insurance companies and FEMA, and we had no plans to quit. But our savings was dying, and we had no way to stop the bleeding. Somehow, I reasoned that Principal will use some common sense and reopen the PUSPSA to withdraws. It had all started with a 15 minute warning, at 11:45 pm on September 26, 2008, that the account was to be locked at midnight to protect all investors from a soon to be financial crisis. They emphasized the fact they had a “fiduciary duty” to do so., and under the law they claimed a right to do so. They never came to reason that they should return our money, at least those at retirement age and still working.

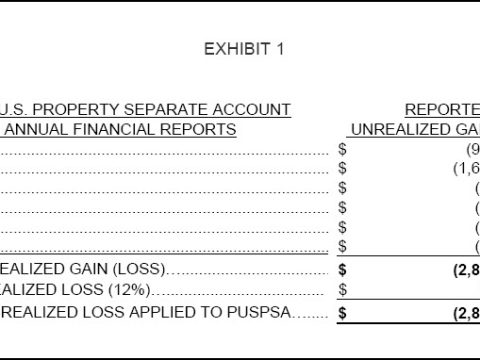

We first accepted the decision believing Principal was doing their duty, but soon, at years’ end 2008, a billion dollars disappeared from the account, soon followed by another 1.5 billion in 2009, and another 500 million in 2010. Finally, in 2011, the account seemed to level off and by years’ end most investors had received their savings, albeit in a grossly reduced amount, and the bad memories were expected to fade, at least from Principal’s perspective.

But for the Myhre’s it was a different story. We had resigned our jobs in 2010, fearful that our entire savings would evaporate, leaving us nearly penniless, and the meager amount we received from Principal was used to extinguish what debt we had, and purchase a small home at auction for $60,000. The $300,000 home we had owned in Branson, Missouri, was sold at less than market value to cover the mortgage.

For the past 12 years I have investigated, and continue to investigate, the “real” Principal Group of Companies. I have identified the methods in which they steal from their 401K clients, leading back an entire generation of Principal executive employees, and involving billions of stolen retirement dollars. What follows in the coming weeks is an expose’ of Principal’s crimes.

A Brief History of Principal Life Insurance Company

Principal Life Insurance Company is a nationwide provider of life insurance and annuities products, with the senior citizen market comprising a large share of its business. In the past, the company has also sold annuity products as Principal Mutual Life Insurance Company. In 2000, Principal Life Insurance settled a class action suit involving approximately 960,000 life insurance and annuity holders. An Iowa district court approved the $374 million settlement in early 2001.

The class action claimed that Principal Life Insurance sales agents deceived the class members into purchasing life insurance and annuity products through the use of false and misleading policy illustrations, marketing materials, and sales presentations. The plaintiffs alleged that Principal Life Insurance made marketing statements and presented sales illustrations that depended on deceptive actuarial assumptions and undisclosed material facts. According to the plaintiffs, Principal sales agents fraudulently concealed the presently known fact that the assumptions upon which the performance of the “vanishing premium” policies were based could not be supported by Principal’s current experience. The plaintiffs also claimed that Principal knew the dividend, interest, and investment return assumptions essential to its sales illustrations could not be maintained, and indeed, their projections did not even indicate that they could be maintained. Nonetheless, the plaintiffs argued that the sales personnel used these illustrations to induce the class members to purchase the life insurance and annuity products.

Aside from the above narrative, there have been multiple legal cases involving Principal’s poor judgement at best, or clearly criminal activities at their doorstep that has been commonplace. Principal’s criminal history has followed the company since it’s inception in 1879, and it’s heritage follows closely behind even today. My focus relates to the Principal Group of Companies, including their affiliates, the stench of which has ruined the lives of millions of 401k savers today, and will continue to do so until the Federal government decides to act on what is obvious, that being the fact that Principal is a grossly corrupted company that must be reorganized by the Federal Government.

Is Principal a Fiduciary?

Before we can decide Principal’s culpability regarding actions they take to relieve the 401k saver of his or her life savings, we need to define Principal’s status as it relates to your savings plan. Of course, all of the pros will tell you to read your Group Variable Annuity contract for answers, but they would be wrong! actually, you will find no reference to the term “fiduciary” in any plan documents you receive from Principal, and you never will. Your savings plan has it’s own label, and you will not find it anywhere as well in your plan documents.

To open this issue, I will quote a comment voiced by the National Association of Insurance Commissioners (NAIC) directed to the American Academy of Actuaries, stating the following, The charge of the NAIC Work Group is to, “Study the need to modify existing regulatory guidance related to separate accounts where, in recent years, various products and contract benefits have increased the risk to the general account.” As a footnote, the following was explained, “A non-unitized separate account is one in which benefits are declared by the insurer and are not directly related to the assets held in the separate account. This contrasts with a unitized separate account, in which benefits are expressed in units whose value varies directly with the value of the separate account, such as a variable annuity. For the purpose of the NAIC analysis and

the SAWG’s comments, we are also assuming that unitized separate accounts would include all types of pass-thru separate accounts, including some non-unitized private placement VUL, since the issues being discussed relate to the nature of the product and its risk to the general account, not to how the product allocates separate account assets among policy or contract-holders.”

As confusing as it appears, it is even more so for millions of separate account investors, whose ownership is controlled by a Variable Group Annuity. With Principal, most 401k plans include the Variable Group Annuity and separate account investments. Your boss does not understand how the separate account works, you do not understand, and as you can see above, even the regulators do not fully understand the function either. There is one word that describes your separate account investment… the State of Iowa will NOT allow you to own your own money, will not allow Principal to claim to be a “fiduciary,” and under almost any circumstance, Principal can steal at random all the value from the separate account you own, and they cannot be stopped.

Who owns the money that is deposited with Principal by your employer every month?

Principal does not market or maintain any separate account product that provides a minimum return or account value guarantee to a contract holder or participant upon contract surrender. But, the problem is that Principal also retains zero risk on the separate accounts as well. Principal has no asset or liability risks with your money, so common law prevails, and since the State of Iowa also tells you that once Principal gets their filthy hands on your money, they own it.

Principal claims they are fiduciaries of the actual separate account, and they can do whatever is necessary to “protect” the account, which does not include protecting the money. From their past activity, it appears that they believe in giving themselves total control with no restrictions, so they steal your money. Pretty simple when you think about it! I hope this is clear for you, because your employer is clueless, and he/she will agree by contract to agree with Principal on any issue that develops if the money disappears, as did happen in 2008-2009.

Has Principal engaged in any money laundering schemes?

During my 12 years of investigating Principal, I discovered at least one instance where they engaged in money laundering, by traditional means, using a regional bank in Maryland. As near as I could tell, Principal executives assumed a role as bank executives, and that was how they were discovered, because their new banking roles showed up of SalesForce.com. The list of names were long, 41 Principal executives, and a few names, like an Iowa Insurance Commissioner, who was hired by Principal after she termed out as the Commissioner.