Principal life Insurance Company markets Group Variable Annuities through 401k plans to Employers. As such, Annuities are regulated by FINRA and the Securities & Exchange Commission. In 2008, Principal placed a withdrawal restriction on the Principal U.S. Property Separate Account (PUSPSA), a popular real estate investment account in which many of their 401k clients invested due to the fact that Principal had re-defined the account as a fixed income account a few months prior to the withdrawal restriction.

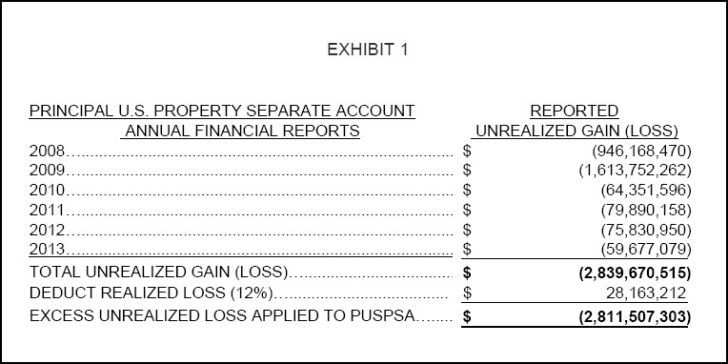

Almost immediately following the restriction, the PUSPSA began to lose value, dropping almost a billion dollars in 2008, then another billion dollars in 2009. Another billion dollars were lost as an unrealized loss in value until 2014, when the account began to recover. By then, the damage had be considerable to the investors, and many lost over a third of their original investment.

The arbitrary estimated market value of the account holdings were recognized as an unrealized loss for six years by Principal, and a review of their financial reports filed annually proved out the fact that Principal’s subjective analysis of unrealized losses was the key player in the account losing billions of dollars in value between 2008 and 2013.

The attached header image illustrates the unrealized losses estimated each year by Principal, as found in the annual reports also attached as Exhibits in this report. Interestingly, EXHIBIT 2 depicts a letter written by then CFO Terrance J. Lillis, also Senior Vice President, in which he discusses at length the function of Principal’s “non-guaranteed separate account,” offered to 401k clients, including the presumption that said accounts represents “zero” risk weight to the insurer as provider of these investments. This chart shows between 2008 & 2010, the PUSPSA lost almost 40% of it’s value, which would account for Principal’s sudden “gift” of over $3 billion. Principal needs to pay back the money they stole, pure & simple, and the SEC and DOJ are the only regulators that can make this happen.

Mr. Lillis did make a point in his letter I will pursue in filing this Whistleblower’s claim. It seems that Mr. Lillis, almost in a boastful manner, on page 8 in the last paragraph, asserts the following statement:

“At year-end 2008, Principal had an after-tax and after-DAC unrealized loss position on AFS debt securities of $4.2 billion dollars. Since then, only a small fraction of that amount has emerged as an actual realized loss. Actual after-tax realized losses on AFS debt securities from 2009 through 2011 have totaled only $507 million, which represents approximately 12% of the original unrealized loss position on these investments.”

By definition, an “AFS debt security” meets the true definition of a Principal separate account such as the Principal U.S. Property Separate Account. On page 9, Mr. Lillis also states that at the end of 2011, Principal had an unrealized gain of $728 million, yet they reported the PUSPSA continued to lose value, up to and including 2013.

His letter really does a fine job of arguing this case for the benefit of thousands of plan providers as well as tens of thousands of 401k savers. If, on the other hand, Mr. Lillis refutes his own letter, I believe the Governors of the Federal Reserve System as well as the Office of the Comptroller of the Currency may have some questions as well. I suspect Mr. Lillis would like to get this matter resolved, as would myself and my fellow 401k savers. The Principal Group of Companies have been ravaging millions of savers of their hard earned savings over the past thirty years, and if this matter goes before a Judge, I have a portfolio of evidence that would likely shut down the company.

My position regarding this matter is for the Principal Insurance Company to reimburse past PUSPSA investors for their losses, by disbursing in full the estimated $3 billion, plus the accrued interest since 2008.

Compare the above header chart and statements made with EXHIBIT 11, which displays a “year-on-year” quarterly growth & shares outstanding chart for Principal. It is obvious that Principal’s financial problems far exceeded Mr. Lillis’s statements in his letter. Principal appears to be well on it’s way to bankruptcy. Principal should have been in a crisis state of mind at this time, their share values had plummeted, and the number of shares outstanding had plummeted as well, as the above graph also shows. In fact, their shares remained below par until 2013, when PFG shares began a slow climb.

EXHIBIT 12 shows Principal’s share value had plummeted at the beginning of 2007, hitting bottom on March 12, 2009, when share price was $7.77. They had been operating in the red early in 2006, and likely much earlier than that date.

Then suddenly, the company was infused with billions of dollars in cash! Of course, Lillis explained in his letter that Principal had no “troubled asset” issues, and didn’t even apply for federal funding. The facts are that they did apply, then learned several of their comrades had been audited and sentenced to prison for their misdeeds. EXHIBIT 13 shows Principal had a serious issue with troubled assets. The chart shows Principal’s troubled assets went through the roof at the same time their shares plummeted, and in March, 2010, almost 50% of their owned assets were underwater. But then, once again, suddenly appears their savior, and their troubled assets plummeted to a normal 15% by year’s end!

I believe the above facts clearly show that things were not as rosy as Mr. Lillis expressed in his letter to the banking regulators. Then SEC Chairperson Mary Shapiro may have agreed, since she called a meeting in her office on Thursday, February 26, 2010, to discuss undisclosed matters. In attendance were Larry Zimpleman, then CEO, James McCaughan, CEO of Principal Global Investors, and Jeffrey Hiller, Chief Compliance Officer (see EXHIBIT 14). As I recall, earlier in the week, she met with the Iowa State Insurance Commissioner.

Several other charts and graphs are available, as well as UCC reports and county records to add more bread crumbs to implicate Principal in a money laundering scheme using the Principal U.S. Property Separate Account. Evidence will show the movement of funds through mortgage lending schemes using the attached Loan Purchase Agreement (EXHIBIT 15), whereby the 401k account would guarantee the loan under any circumstance.