Now that the foundation of 12 years of investigation of Principal Life Insurance Company has been submitted to the Securities & Exchange Commission (SEC) and the Department of Justice (DOJ), the clock starts running for Principal… Based on information and belief, the best estimate is that Principal stole at least $3 Billion, and possibly $4-$6 Billion from 401k investors during the past 20 years, mostly from the Principal U.S. Property Separate Account. They were able to accomplish that feat by gaining the confidence of multiple federal agencies and politicians, paying out tens of millions in lobbyist funding to our federal government.

Today, many of the perpetrators involved have retired, but Principal is being placed on notice at this time for a good reason. Both the SEC and the DOL have in place amnesty options to avoid prison terms and/or heavy fines if the corporate entity self-reports the wrongdoing within 120 days of the receipt of the Whistleblower’s report. The clock is running, and if Principal fails to self-report by even 1 hour after the deadline to do so, the die is cast. The risks for Principal not to self-report is so high, it would make no sense to delay the inevitable. First, like those whose lives they destroyed by stealing their savings, the Principal executives will pay a high price themselves if they receive prison terms. Most of the politicians and federal agency managers and employees who accepted bribes and other gratuities from Principal have moved on as well, and those in positions of authority in deciding this case have no reason to protect the guilty.

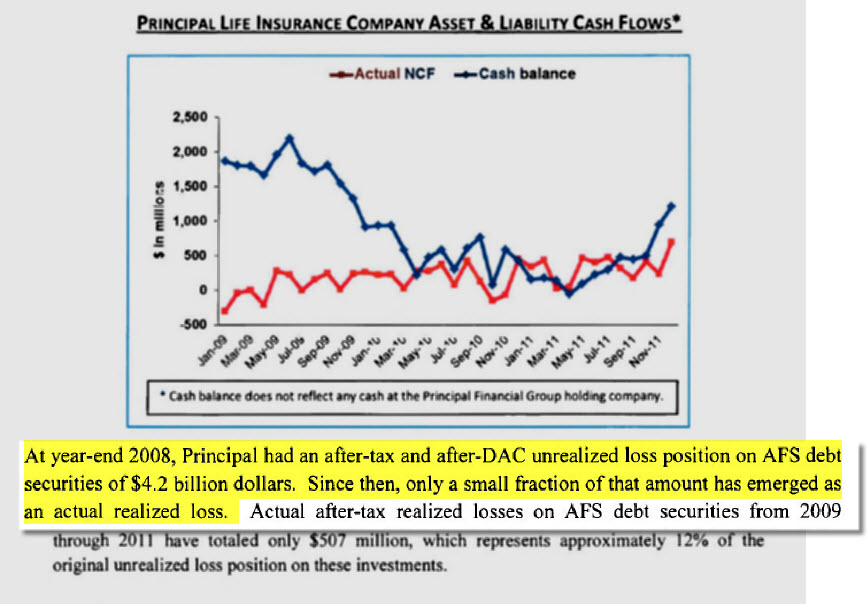

The above graph is perhaps the most convincing evidence to support a decision for the SEC/DOJ to prosecute should Principal fail to self-report. When used with other existing evidence, it leaves a trail of breadcrumbs of corruption within the company. When viewing this chart in comparison with the Website header image, the header image displays a large influx of cash during the same time the Principal U.S. Property Separate Account was in a withdrawal restriction status. Since Principal is shown in the red financially prior to and following the time periods involved, an investigator could easily reason that the excess funds came from the PUSPSA.

Several other charts and graphs are available, as well as UCC reports and county records to add more bread crumbs to implicate Principal in a money laundering scheme. Evidence will show the moving of funds through mortgage lending and altering agency required reports by understating the number of plan sponsors during that same period of time,.

The only remaining task is to convince Principal the facts are on the table. Past posts I have published in the past were generalities, mostly lacking evidential material; future posts will provide a detailed description of the course of events that led us to where we are today. Once Principal self-reports, it will then be prudent for me to unpublish fiduciaryfactor.com and allow legal decisions write the final chapter.