Each year 401k retirement funds are stolen by service providers through money laundering…

Each year billions of dollars in 401k funds are stolen by service providers through money laundering. Money laundering usually involves collusion of two or more corporate bodies, typically a bank and a financial institution, like an insurance company.

The Federal Bureau of Investigation describes Money Laundering…

“Money laundering is the process by which criminals conceal or disguise their proceeds and make them appear to have come from legitimate sources. Money Laundering allows criminals to hide and accumulate wealth, avoid prosecution, evade taxes, increase profits through reinvestment, and fund further criminal activity. While many definitions for money laundering exist, it can be defined very simply as turning “dirty” money into “clean” money. And it’s a significant crime—money laundering can undermine the integrity and stability of financial institutions and systems, discourage foreign investment, and distort international capital flows. The FBI focuses its efforts on money laundering facilitation, targeting professional money launderers, key facilitators, gatekeepers, and complicit financial institutions, among others.

There are three steps in the money laundering process—placement, layering, and integration. Placement represents the initial entry of the criminal’s proceeds into the financial system. Layering is the most complex and often entails the international movement of funds. Layering separates the criminal’s proceeds from their original source and creates a complex audit trail through a series of financial transactions. And integration occurs when the criminal’s proceeds are returned to the criminal from what appear to be legitimate sources.”

Securities and Commodities Fraud…

“The continuing integration of global capital markets has created unprecedented opportunities for U.S. businesses to access capital and investors to diversify their portfolios. Whether through individual brokerage accounts, college savings plans, or retirement accounts, more and more Americans are choosing to invest in the U.S. securities and commodities markets. This growth has led to a corresponding rise in the amount of fraud and misconduct seen in these markets. The creation of complex investment vehicles and the tremendous increase in the amount of money being invested have created greater opportunities for individuals and businesses to perpetrate fraudulent investment schemes.”

The FBI anticipates that the variety of securities and commodities fraud schemes will continue to grow as investors remain susceptible to the uncertainty of the global economy. To investigate and help prevent fraudulent activity in the financial markets, the Bureau continues to work closely with various governmental and private entities. If you have been a victim of financial crimes, including identity theft, you should contact the FBI. If your name is included in this chart, and you did engage in money laundering, you should be worried. If you name is on the list, and you did NOT have an email address as described below, then you should contact the FBI and inform them you have been a victim of identity theft.

The Principal Life Insurance Company…

A few years ago, Principal Life Insurance Company froze the assets of hundreds of thousands of 401k investors. The account was the Principal U.S. Property Separate Account, then valued at approximately $8 billion. Principal expressed concerns that if the account was left accessible to the investors, there would not be enough liquidity to meet the demand for the withdrawals.

A few years ago, Principal Life Insurance Company froze the assets of hundreds of thousands of 401k investors. The account was the Principal U.S. Property Separate Account, then valued at approximately $8 billion. Principal expressed concerns that if the account was left accessible to the investors, there would not be enough liquidity to meet the demand for the withdrawals.

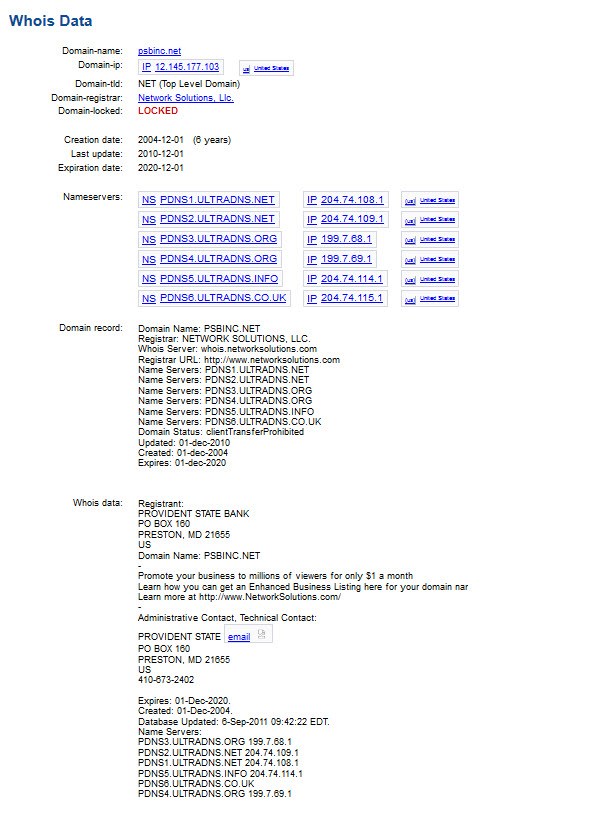

Meanwhile, a thousand miles east, in a small community in Maryland, a local bank had previously created a new domain name, psbinc.net, and registered it with Network Solutions, llc. The domain had multiple name servers, including one located in the UK called PDNS6.ULTRADNS.CO.UK, with an IP address of 204.74.115.1., linked to several European locations.

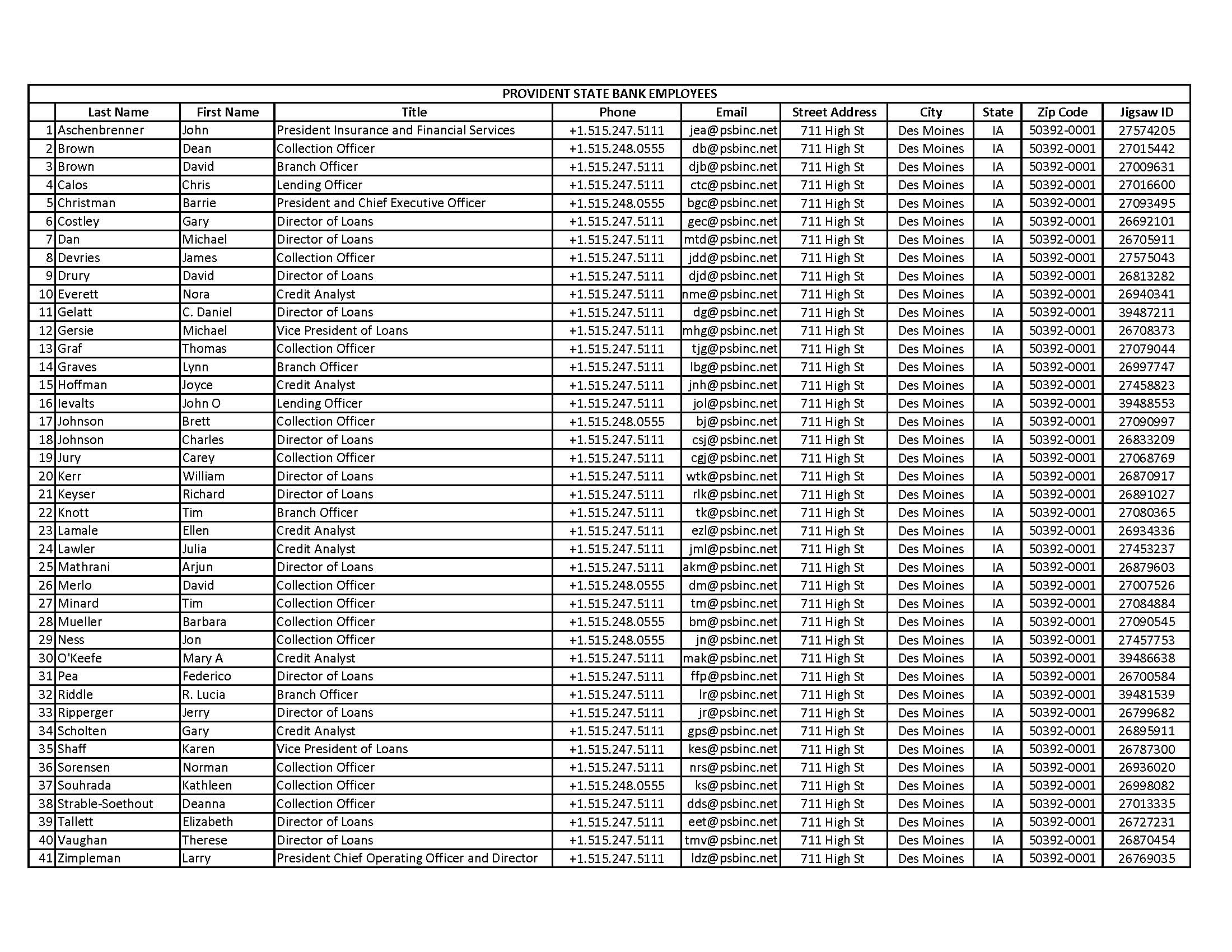

That same IP address shared a route through Des Moines, Iowa, near the headquarters of Principal Life Insurance Company. As if that wasn’t enough of a coincidence, 41 Principal executives and board members also shared titles with the bank in Maryland. Titles such as Collection Officer, Director of Loans, Branch Officer, Lending Officer and Credit Analyst were among the most common.

These 41 individuals reportedly had email addresses linked to the Maryland bank, using initials instead of names. The President and Chief Executive Officer of Principal Life was the President and CEO of the Des Moines branch of the bank located in Maryland. The following names were published in Jigsaw, aka Sales Force.com, a popular resource for business referrals, along with their titles and email addresses linked to the bank in Maryland.

I contacted the State of Iowa, and they reported there is no charter for this bank in the State of Iowa, so I am not sure how these individuals can hold these titles for a bank located in Maryland, and do business in Iowa.

Real Estate Investment Companies are at the top of the list of entities potentially engaged in Money Laundering, representing over 30% of the total occurrences. In the case of the Principal U.S. Property Separate Account, the investments were entirely commercial real estate investments, the greatest target for money laundering opportunities.

Do these documents support an allegation that Principal Life engaged in money laundering during the years leading up to the financial crisis in 2008? I am not a criminal investigator. Someone engaged in fraud investigation may review these attachments in the future and draw valid conclusions. Predictably, someone will step forward. Until then, I can only report, and you draw your own conclusions.

If your 401k investments include real estate investment accounts like the Principal U.S. Property Separate Account, you should have some valid concerns. Review your portfolio with a Registered Investment Adviser, one who is a fiduciary under the Department of Labor rules governing fiduciary relationships. Understand where your money is invested. Read the “fine print.” If you have invested in any insurance company separate accounts, you no longer own any financial assets. You do not own stock in any investments… read the fine print… the insurance company can “freeze” your 401k retirement account at any time, and perhaps when you may need it most.