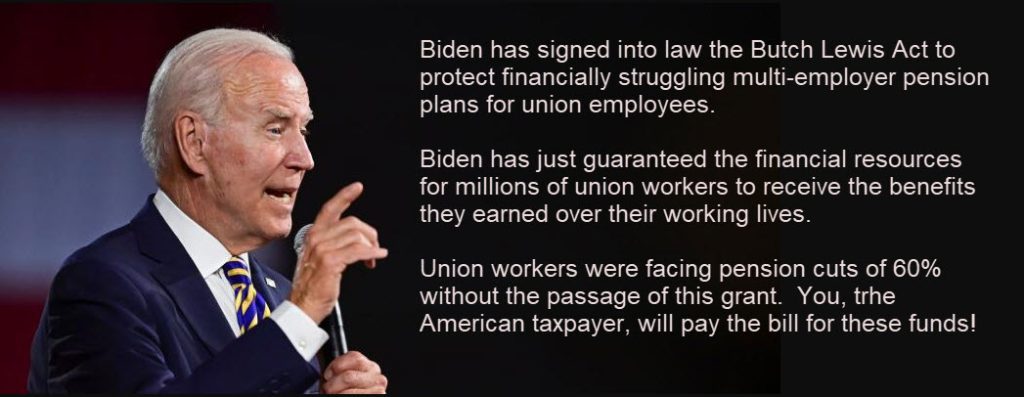

Ok, I get it… Biden got tight with the unions sick leave issues and is trying to make it better, but PERHAPS this is a bit of overkill? He signed into law a Grant (apparently perpetual) guaranteeing that union pension funds are now “guaranteed” for decades to come. No-one really knows how many billions of dollars will now be funneled into union bosses pockets by the passage of this bill… but it reads like a fairy tale for corrupt union officials.

Called the “Butch Lewis Act,” thousands of retired truck drivers, warehouse workers and spouses across the country are celebrating the approval of an infusion of funds that will keep the Central States Pension Fund going strong for decades to come. Congress designed the Butch Lewis Act to protect the pensions of millions of workers and retirees in multiemployer pension plans, which are jointly run by a union and two or more employers. If you click on the above link, the Heritage Foundation has published a great article on the cost of this newly passed bill by your president!

Without this becoming law, it has been projected that the insurance fund managed by the Pension Benefit Guaranty Corporation (PBGC) could become insolvent by the year 2026. First, the bailout of college loans still on the books with the Feds, and now the union pensions. Not only, as a 401k investor, your “self-managed” savings plan is quickly becoming corrupted by insurance companies like the Principal Group of Companies, but you taxes, if you pay any taxes, with absorb the losses in public pension plans caused by corrupt union leaders. And Biden is so hungry for your money, do not even think about spending $600 in a single purchase through PayPal, because he will know about it and tax you for that as well. With all those Federal IRS agents looking for tax fraudsters, perhaps they could start by looking in their own backyard!

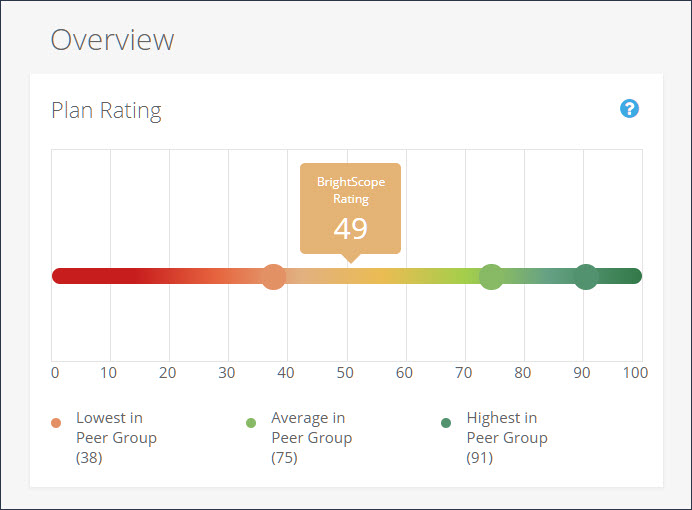

So, where am I going with this new perpetual debt picture every taxpayer has now inherited thanks to the President? Early projections are that the multiemployer pension woes could cost 20 times the projected cost… upwards of $638 billion. Yet, ripping off 401k savings plans could easily exceed in the trillions of dollars! If you think my Website is the ONLY resource online extolling the woes of our 401k plan, do a Google search for “value of stolen funds in the 401k savings plan.” My Website does not even make the first page. Take some time to browse through this cornucopia of articles about how easy it is to steal from your 401k retirement savings plan. Even my fiduciaryfactor website, which is focused on one plan provider, the Principal Group of Companies, does not even scratch the surface of the crimes committed by other corrupt plan providers in an effort to take ownership of your life savings!

I guess the message I am trying to pass on regarding the recent Butch Lewis Act news article, is the fact that most employed individuals such as yourself do not have the luxury of having a Mr. Biden fight your battles, nor even the Department of Labor. In February of 2022, the U.S. Securities and Exchange Commission (SEC) announces their new proposal to “enhance private fund investor protection” by increasing transparency, competition, and efficiency in the $18-trillion marketplace.