It’s March 11th, the Coronavirus has been declared a pandemic, and your 401k account is plummeting in value. For those that have followed my posts over the past near decade, you will understand I have a dislike for Principal Financial Services… and if your service provider is Principal, you will likely soon share my disdain for the company.

It is likely that you will soon receive an email message from Principal… it will read something like… “To protect all 401k investors,” we have frozen all investments your 401k plan. They can do that, as long as they disclose the information.

The first thing you should do if your 401k plan service provider is Principal Life Insurance Company… read the disclosures!! then read them again!! Most savers never read the documents that your employer is required to provide you with when your plan is created. Chances are no one in your company has read them. The Principal representative has a warm and cozy meeting with the boss and possibly the employees, expounding on the benefits of doing business with Principal. Your boss signs on the dotted line, you set up access to your 401k account through their website… all is good in fantasy world!

In the months that followed, you notice a steady increase in the account balance… you are happy, Principal is apparently treating you right.

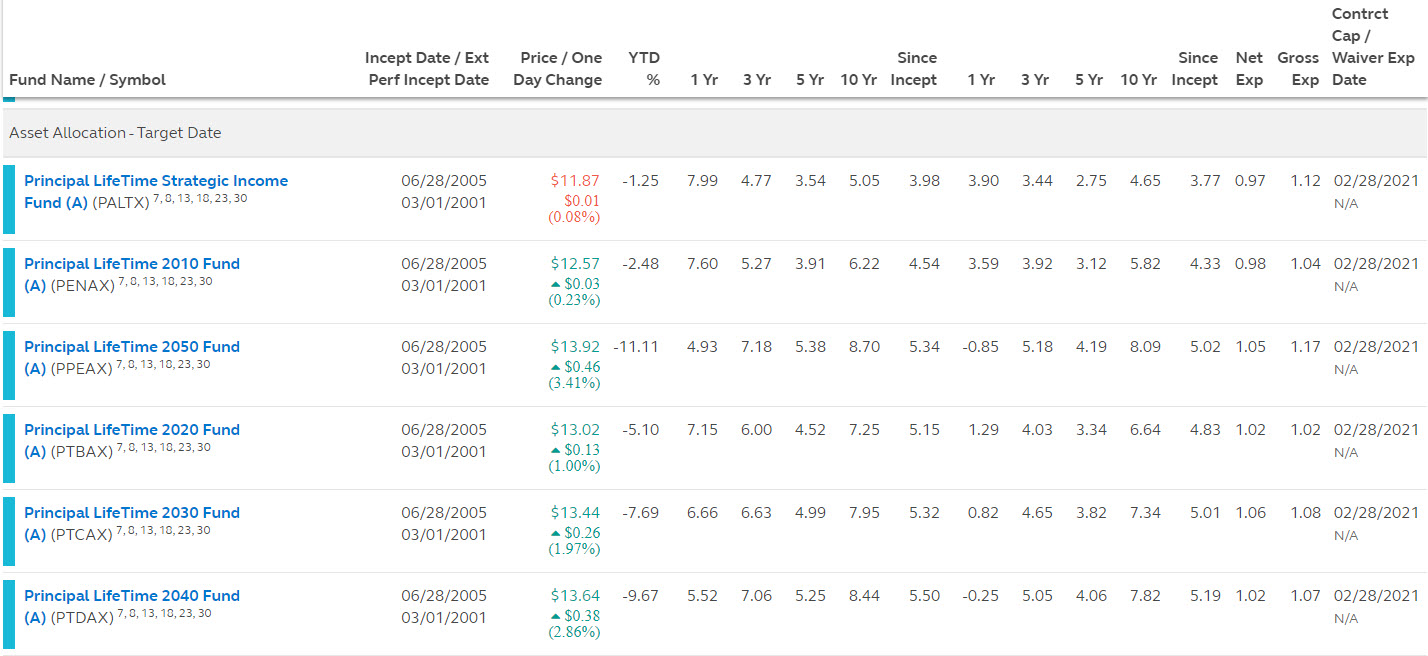

Briefly, if your 401k plan includes Principal pooled separate accounts, you will find a disclosure that effectively states Principal can “defer payments” when they feel it is appropriate to do so. In 2008, the disclosure was only found in the Principal U.S. Property Separate Account (PUSPSA)… one account out of 25-30 investment options. Today, you will find this disclosure in all or most of the pooled separate accounts offered by Principal.

Your employer may think that Principal must be doing this to “protect” you, their investor, in times of financial turmoil. The fact is that Principal will freeze access to your 401k pooled separate accounts to maintain sufficient liquidity to protect the most volatile investments Principal owns in their corporate portfolio!

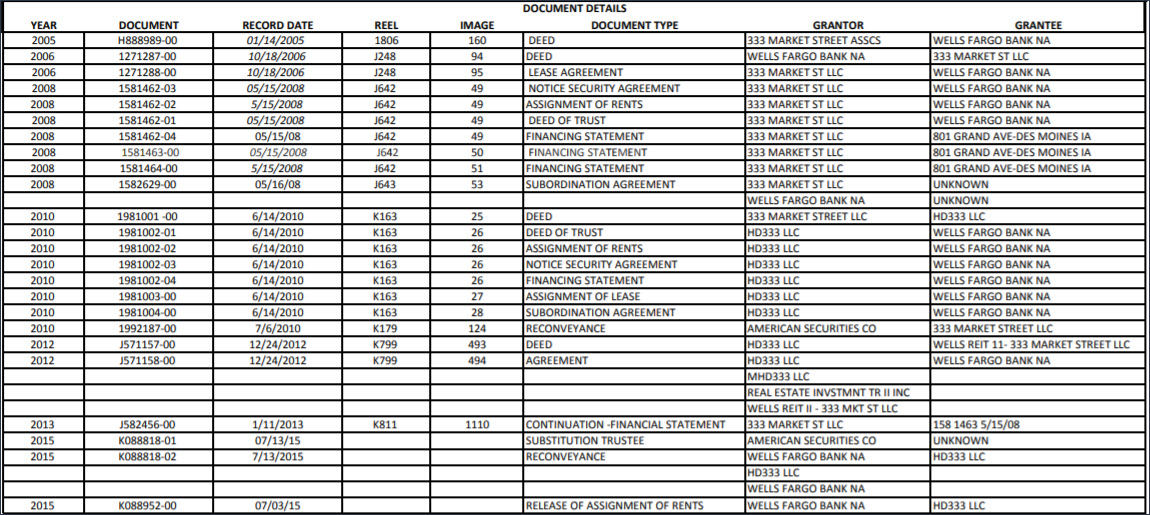

In 2008, Principal froze the PUSPSA, a privately held commercial real estate fund, in which 401k savers could purchase “units of value” that supposedly shadowed the fund. Like today, the pooled separate account owned nothing. Principal held the properties, all of which were shell companies, and supposedly purchased these properties on behalf of the PUSPSA. the only problem was that all retained earnings from these shell companies were re-directed into Principal’s General Account as income. They received special permission from the SEC to do so since, technically, the income derived from these investments were not considered income for the investors. the investors were entitled to only the increase, or decrease, in market value, “as determined by Principal Management.”

This article was published by Yahoo Finance March 10th… clearly, Principal’s stock is in trouble…. losing 36% share value in a month reflects on the viability of a company to continue in business. Yet, in 2008, Principal’s share value plummeted to almost $7 per share, but they recovered with the help of their 401k account-holders. Unfortunately, the account-holders paid the price for Principal’s inept ability to manage their own money.