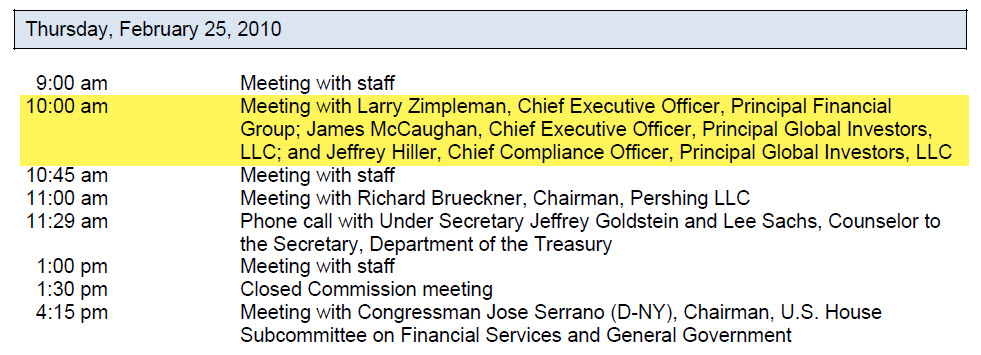

Beginning in 2006, the Principal Group of Companies managed by former COO/CEO Larry Zimpleman, ranked near the top as one of the most corrupt companies providing services to 401(k) investors during that time. The evidence can be found in almost every commercial real estate investment bought or sold for the Principal U.S. Property Separate Account, A REAL ESTATE SEPARATE ACCOUNT SOLD TO 401(K) INVESTORS. Perhaps the most obvious example of Zimpleman’s hunger for defrauding investors can be found in the purchase of 1412 Broadway in New York City, NY.

1412 BROADWAY, located in New York City, was owned by SL Green Realty prior to 2001. In 2001, Green sold the property to JER Partners, a subsidiary of J.E. Robert Cos., for $91.5 million. An existing mortgage was also assigned to Connecticut General Life Insurance Company at that time. In 2004, Cigna purchased a mortgage assignment from Connecticut, and later that same year, JER Partners sold the commercial property, deeded at $98 million, to Murray Hill Properties, LLC, aka 1412 Owner LLC. When Murray Hill took ownership, the existing loan was once again sold, this time to Bank of America by Prudential f/k/a Cigna Life. The consolidated loan value at that time was $89,000,000. Two months later, on March 4, 2005, the mortgage was sold by Bank of America to Principal Life Insurance Company.

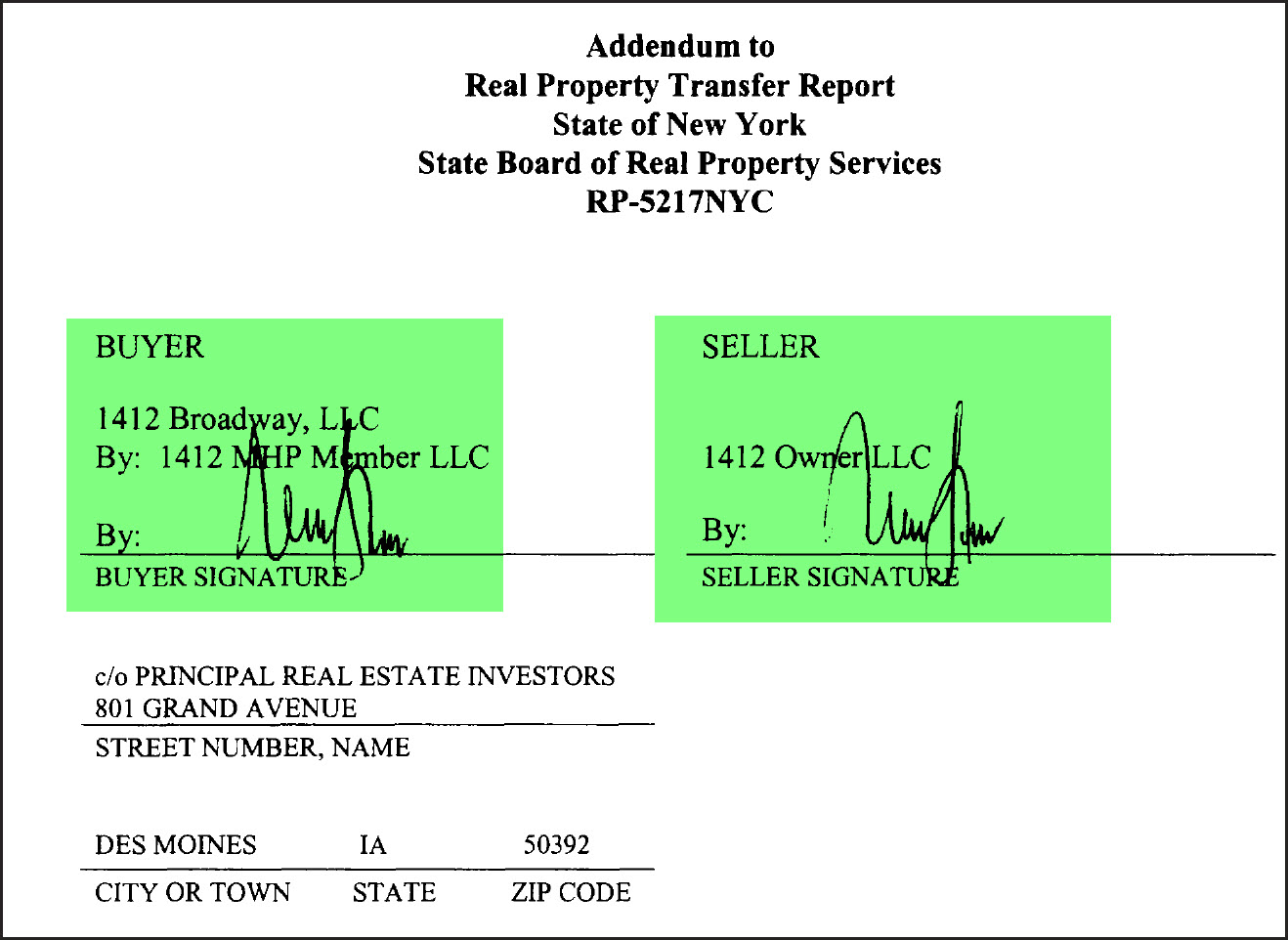

On November 20, 2006, Principal Life bought 1412 Broadway for the Principal U.S. Property Separate Account (PUSPSA), a separate account Principal offered to 401(k) investors. Priced at $178,400,000, the purchase price was twice what Murray Hill Properties had paid several months earlier. A deed was issued in fee interest to 1412 Broadway LLC, a shell company formed by Principal (DEED – 11-20-2006). Norman Sturner, principal owner of Murray Hill Properties, signed as seller for 1412 Owner LLC. Also, on the addendum to the Real state Transfer Report attached to the recorded deed, Sturner signed as both buyer and seller, showing the buyer’s address as Principal Real Estate Investors located in Des Moines, Iowa…

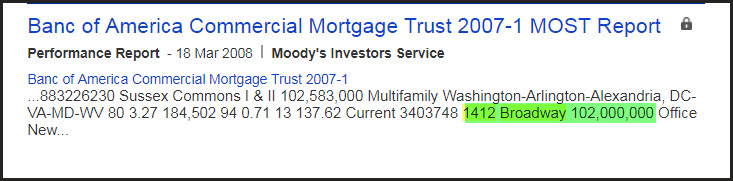

On that same date, Principal Life completed a Mortgage Assignment back to Bank of America (MORTGAGE ASSIGNMENT – 11-20-2006), and Bank of America completed a Mortgage Assignment to Mortgage Electronic Registration systems, Inc (MERS MORTGAGE ASSIGNMENT – 11-20-2006). Within a few days, The mortgage was securitized in a Trust for Banc of America Commercial Mortgage Trust 2007-1, sold as a CMBS….

Three years later, the MEZZANINE LOAN HAD DEFAULTED, AND THE 2009 PUSPSA Annual Report reported the sale of the property for $109,400,000, a reported loss for investors of $70 million!

Principal had lied…. The investment partner, Norman Sturner with Murray Hill Properties, tells a different story in this article published in Observer.com. Sturner is quoted as saying the following:

“We are happy to report that we have concluded the purchase and recapitalization of 1412 Broadway,” began a recent email sent by Murray Hill Properties owner Norman Sturner to his investors. The article continues….This is the 400,000-square-foot, Class B garment-district building at 39th Street that Mr. Sturner and his partners (PUSPSA) bought for $177.5 million in December 2006, right at the height of the frenzied real estate market. After searching for new investors from within the ranks of New York real estate’s moneybag set, Mr. Sturner told The Commercial Observer that he ended up recapitalizing the building using money from funds managed by his firm. “It’s a great coup for us,” Mr. Sturner said. “I’m unhappy that my partner asked to be bought out, but we did what we had to do.” His partner also has reason to be unhappy. Mr. Sturner’s funds paid $5 million to purchase and retire a $20 million mezzanine loan from TIAA-CREF—wiping out $15 million for that investor. “In addition, we completed the equity recapitalization by purchasing our joint-venture partner’s interest in the property totaling $68.5 million for $6 million,” Mr. Sturner wrote in his email. “As you can see we have reduced the previous capital stack from $197.5 million to approximately $120 million…” That, in turn, wiped out more than $60 million for his investment partner.”

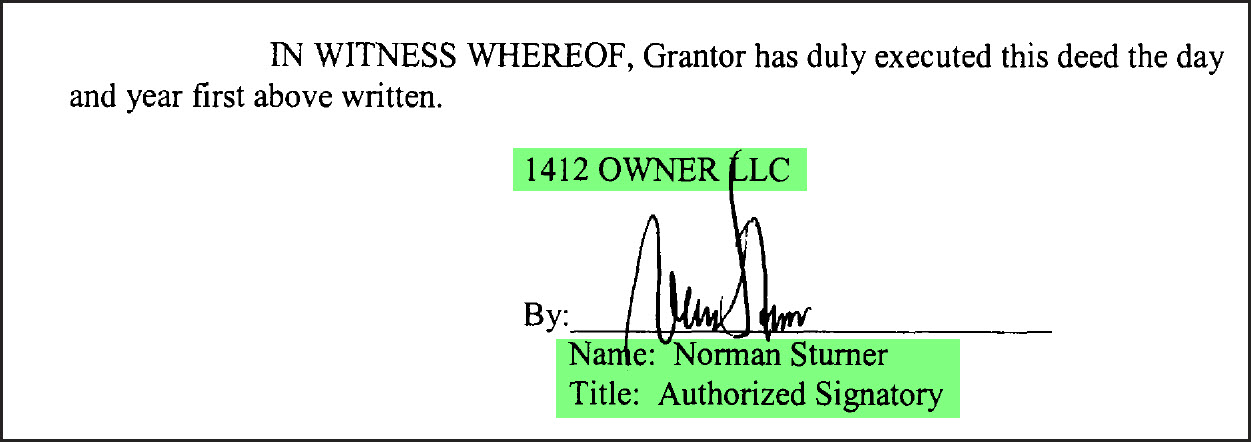

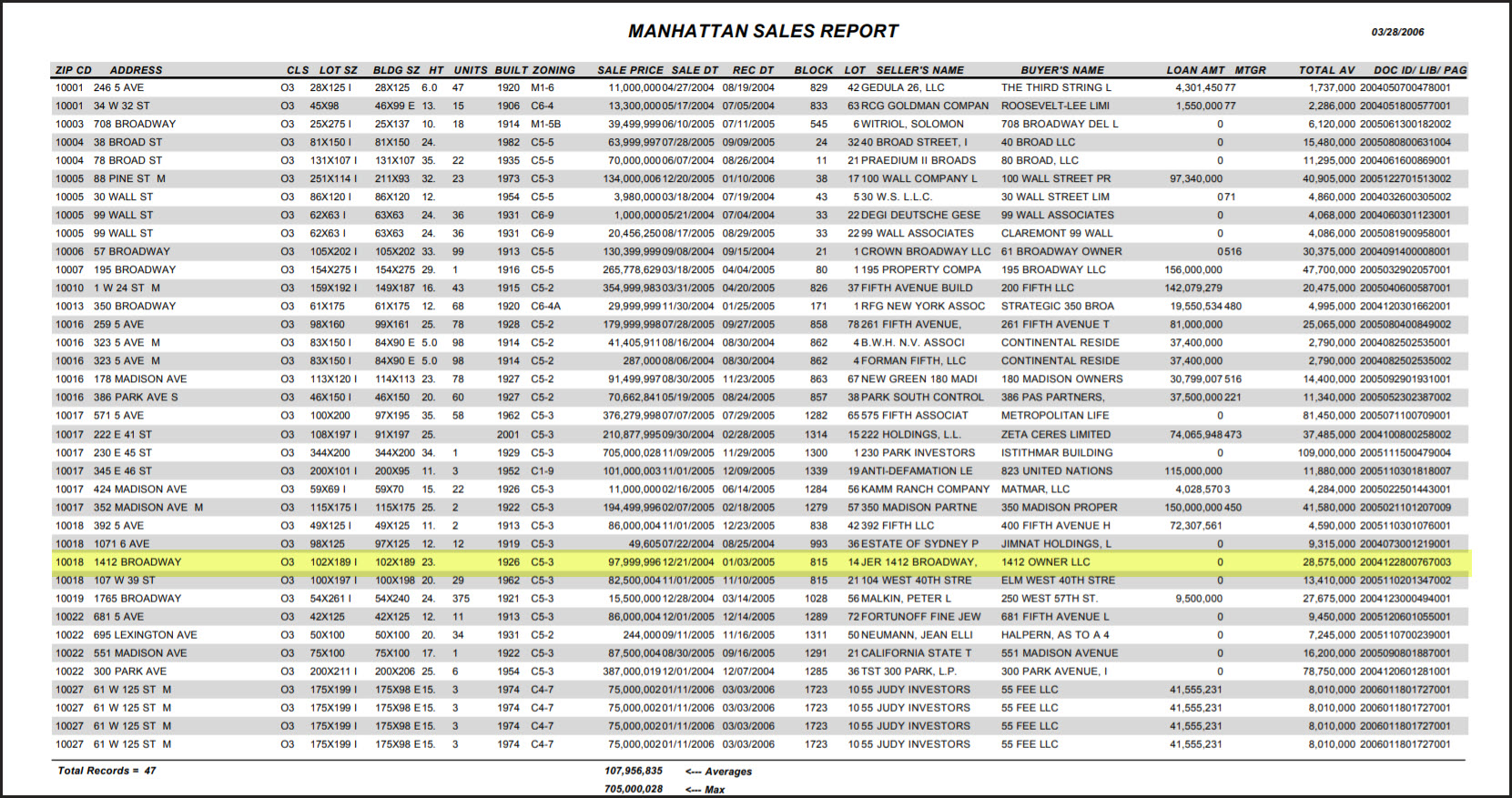

Sturner and Murray Hill had actually purchased the property on 12/21/2004, two years earlier than reported to the Observer, …calling it 1412 Owner LLC, almost two years before Principal bought in as a partner for the PUSPSA. According to this “Manhattan Sales Report”, Murray Hill paid $97,999,996 on 12/21/2004! 1412 Owner LLC was Murray Hill Properties, as this Grantor/Seller shows from the Bargain and Sale Deed filed in 2006:

1412 Owner LLC was Murray Hill Properties, as this Grantor/Seller shows from the Bargain and Sale Deed filed in 2006:

Murray Hill also owned the mortgage that Principal purchased from Bank of America on 3/4/2005, two months after Murray bought the property. The property that cost Murray Hill $98 million in 2004, cost the separate account $178,500,000 2 years later! Principal had also obtained a mezzanine loan for another $20 million that they defaulted on with TIAA-CREF investors, another retirement account invested in by teachers nationwide! It is likely the PUSPSA had to pay off that debt as well. To review the full article, click here.

The PUSPSA 2009 Annual Report states that the property was “sold” in 2009 for $109.4 million. The records filed with the county support Sturner’s statement that he bought us out for $6 million! Doing to the math, the account suffered a gross asset loss of $172,400,000 over a 3 year period, and most likely paid off another $117 million in debt! With the dust settled, Principal defrauded investors out of over a quarter of a billion dollars, using commercial property valued at $98 million! Principal Life Insurance Company owned the mortgage when the property was purchased for the PUSPSA, a clear conflict of interest under ERISA. But Principal is NOT a fiduciary, and has no requirement to comply with ERISA.

The so-called purchase of 1412 Broadway by Principal Life for the Principal U.S. Property account was a hoax. Perpetrated by Principal, they were able to defraud investors of hundreds of millions of dollars by reporting a fake purchase, securing a loan and wrapping it in a CMBS, then defaulting on the mezzanine loan and “selling” the fake property. The deed clearly shows the fake sale was made “fee interest only” to Principal. This was not a joint venture between the PUSPSA and Murray Hill Properties; it was a joint venture between Murray Hill and Principal Real Estate Investors, possibly without the knowledge of Murray Hill Properties.. Neither Principal Life nor the PUSPSA is mentioned anywhere in the documents recorded with New York County…

Former CEO Larry Zimpleman should be implicated by CEO Dan Houston in this well documented crime spree, and prosecuted for investor fraud. Included in any Plea Agreement must be a restitution clause to make all investors, victimized by Principal’s criminal element whole again, including their economic loss. The Department of Justice needs to get off their butts and prosecute these criminals. “Principal Life Insurance Company” is an organization, a grouping of buildings located in Des Moines, Iowa. As such, “it” cannot breathe, move around, and the organization definitely cannot commit crimes. The Federal sentencing guidelines MUST be rewritten to exclude “organizations” from the rulings. Organizations cannot commit crimes, people do, and the SEC laws clearly state that fact. The SEC laws define “persons,” not organizations, as the criminals, and we as a nation need to start making people accountable for their crimes. Until the government takes a positive move towards enforcement against individuals, corruption will continue to prevail in the 401(k) industry.

As a potential whistleblower, you could stand to earn a million dollars or more by reporting any insider information you have concerning this property!!! At the same time, you could help bring one of Principal’s own executives to justice if prosecuted. All while remaining anonymous!